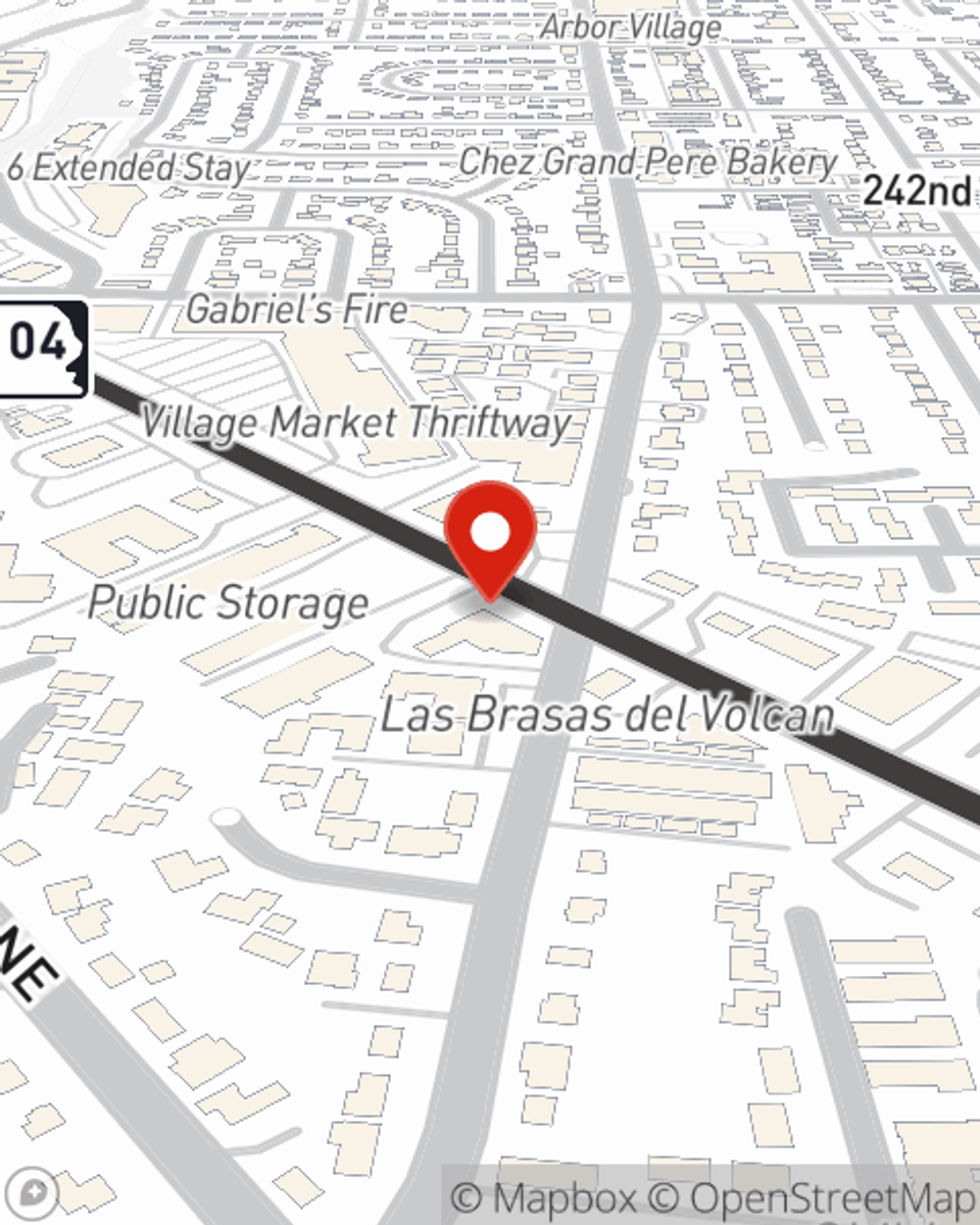

Business Insurance in and around SHORELINE

Get your SHORELINE business covered, right here!

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, a surety or fidelity bond and worker's compensation for your employees.

Get your SHORELINE business covered, right here!

Helping insure small businesses since 1935

Protect Your Future With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Laarnie Soma for a policy that covers your business. Your coverage can include everything from a surety or fidelity bond or errors and omissions liability to commercial auto insurance or group life insurance if there are 5 or more employees.

Call Laarnie Soma today, and let's get down to business.

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Laarnie Soma

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.